There’s a lot to consider when managing currency exchange on international trips, and being well-informed can save you time and money. Knowing how to navigate foreign currencies, exchange rates, and transaction fees can enhance your travel experience. In this guide, you’ll learn imperative strategies to ensure you get the best value for your money, keep your funds secure, and simplify the process so you can focus on enjoying your journey.

Key Takeaways:

- Research local currency and exchange rates to ensure you get a fair deal.

- Use ATMs to withdraw local currency as they often provide better rates than exchange booths.

- Notify your bank or credit card company of your travel plans to avoid issues with transactions abroad.

- Carry cash for small purchases, as many places may not accept cards.

- Monitor fees related to currency conversion, as they can add up quickly while traveling.

Understanding Currency Exchange

While initiateing on an international trip, it’s important to grasp how currency exchange functions. Currency exchange is the process of converting one currency into another to facilitate transactions in foreign countries. This understanding will not only help you budget effectively but also prepare you for the financial aspects of your travels, allowing for smoother transactions and better financial control.

How Currency Exchange Works

One of the primary components of currency exchange is the exchange rate, which determines how much of one currency you will get for another. These rates fluctuate continuously based on supply and demand in the global market. When you exchange your money, you’re importantly buying another currency at that current rate, and it’s wise to compare rates from different sources to get the best deal.

Factors Influencing Exchange Rates

While navigating currency exchange, several factors can influence exchange rates, making it important for you to be aware of them. These factors include:

- Interest rates

- Inflation rates

- Political stability

- Economic performance

Perceiving how these elements affect currency movements can help you make informed decisions during your travels.

To further enhance your understanding, it’s useful to analyze these factors regularly as they can change rapidly, impacting your travel budget. Consider tracking the following elements:

- Market trends

- Government policies

- Trade balances

- Global events

Perceiving these influences allows you to time your currency exchanges wisely, maximizing your spending power while abroad.

Tips for Preparing Before Your Trip

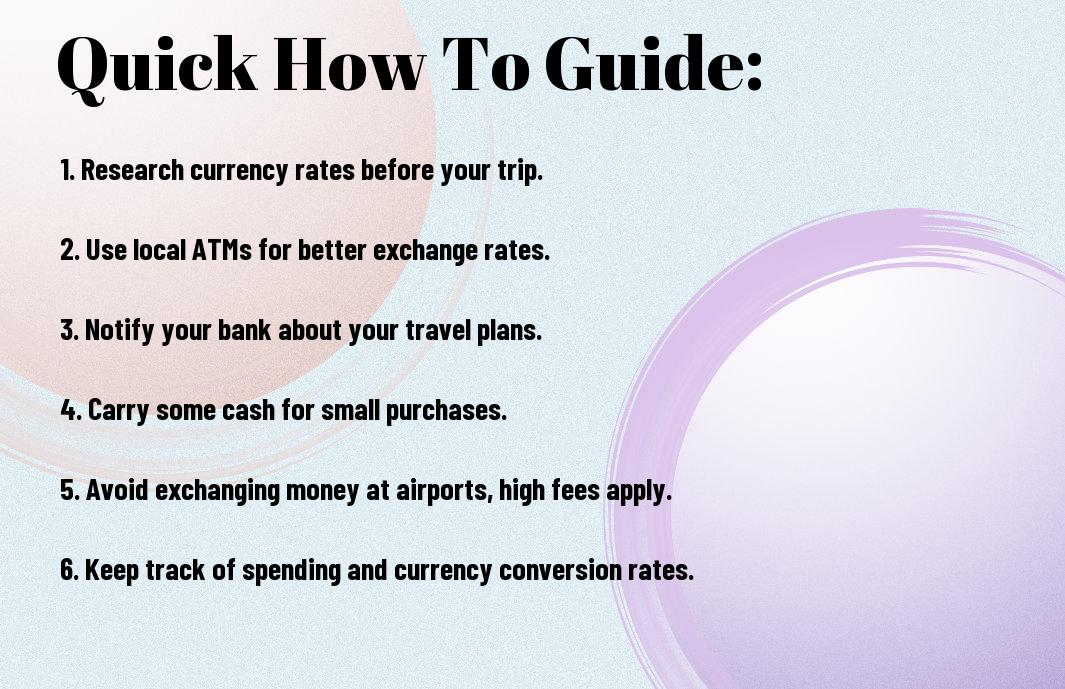

Clearly, preparing for currency exchange ahead of your trip can make the process smoother. Consider these tips:

- Check the exchange rates in advance.

- Inform your bank about your travel plans.

- Get a small amount of local currency before departure.

- Research local ATMs and credit card fees.

- Download useful currency converter apps.

Perceiving these steps as part of your travel planning will set a positive tone for your journey.

Researching Currency Options

Before visiting a new country, it’s imperative to research the currency options available to you. Investigate where to exchange money, whether at banks, airports, or local currency exchange services. Compare rates and fees to find the most favorable option, as differences can significantly impact your budget during your trip.

Setting a Budget for Currency Exchange

There’s no doubt that setting a budget for currency exchange is important for effective financial management while traveling. Determine how much money you’ll need in the local currency and plan for expenses beyond just accommodations and meals, such as activities and transportation.

Options vary widely when it comes to setting a budget for currency exchange. You might want to set aside a percentage of your overall travel budget specifically for currency conversion and potential fees. Be mindful of fluctuating exchange rates and consider using a travel card that offers competitive rates while minimizing transaction fees. This approach can help you maximize your spending power abroad without overspending or running into financial difficulties during your trip.

How to Exchange Currency Abroad

Many travelers find themselves needing to exchange currency once they arrive at their international destination. Familiarizing yourself with your options for exchanging money can save you from unnecessary fees and unfavorable exchange rates. Whether you choose to use local banks, currency exchange services, or ATMs, knowing the pros and cons of each can help you make informed decisions that ensure you maximize your funds while abroad.

Local Banks vs. Currency Exchange Services

Clearly, local banks often offer better exchange rates than currency exchange services, which may charge higher fees and provide less favorable rates. However, banks may have limited operating hours and could require a specific identification process. Currency exchange services, meanwhile, are often located in tourist areas for convenience but can be less cost-effective. It’s advisable to do a bit of research and compare these options in advance.

Using ATMs Wisely

Exchange rates found at ATMs can be more favorable than those offered by currency exchange services, but it’s important to use them wisely.

Currency exchange through ATMs can be advantageous if you choose machines associated with your bank or credit union, as they typically offer lower fees. Always select to withdraw money in the local currency to avoid dynamic currency conversion fees, which can inflate costs. Additionally, notifying your bank about your travel plans can prevent your card from being flagged for suspicious activity. As you plan your trip, make sure to research which ATMs are available at your destination to optimize your currency exchange experience.

Tips for Avoiding Currency Exchange Pitfalls

Now, when traveling internationally, it’s crucial to stay vigilant about currency exchange to avoid unnecessary losses. Here are some tips:

- Always compare rates before exchanging money.

- Avoid exchanging currency at airports or tourist hotspots.

- Use local ATMs with low withdrawal fees.

- Be cautious of offers that seem too good to be true.

This way, you can keep your finances in check during your travels.

Hidden Fees and Commissions

Tips on currency exchange often overlook the hidden fees and commissions that can erode your funds. Ensure you ask about all applicable charges before exchanging your money, whether at a bank, currency exchange counter, or airport kiosk. Always read the fine print and understand how much you’re truly losing to fees. It can make a significant difference in how much local currency you actually receive.

Recognizing Scams and Unfavorable Rates

Assuming you’ll get a fair exchange rate can lead to significant losses if you’re not careful. Many tourists fall victim to scams, especially in busy areas. Always be skeptical of exchanges that appear too accommodating or those that display rates that deviate wildly from local norms. Bookmarked online resources often provide current market rates, and utilizing them can guide you in making informed decisions during your trips.

A common red flag is when exchange booths offer rates that are significantly better than those of banks or local ATMs. Such offers often come with hidden scams or misleading advertising. It’s best to research trustworthy exchange spots and opt for those that transparently display rates and terms. By staying vigilant, you can safeguard your money while enjoying your travels.

Managing Currency During Your Trip

For a smooth travel experience, it’s important to manage your currency wisely during your trip. Familiarize yourself with the local currency, monitor exchange rates, and consider using a travel-friendly debit or credit card that minimizes foreign transaction fees. Keep a mix of cash and digital payment options to handle various situations while ensuring you stay within your budget.

Tracking Your Spending

Currency management becomes easier when you actively track your spending. Use budgeting apps or simple note-taking methods to record your expenses daily, helping you stay organized and avoid overspending. Review your spending patterns to adjust your budget as needed, ensuring you can enjoy your trip without financial stress.

Best Practices for Carrying Cash

For added security and convenience, learn best practices for carrying cash abroad. Avoid carrying large amounts and keep cash in different locations, such as in your wallet and a secure zippered bag. Always ensure that you have small denominations on hand for local vendors, tips, and public transportation, which often don’t accept cards.

With a little foresight, you can effectively carry cash without risking loss. Use a money belt or hidden pouch for larger sums and reserve your wallet for smaller amounts. It’s wise to inform your bank of your travel plans in advance so that your cards remain operational abroad. By keeping your cash organized and secure, you can focus on enjoying your trip.

Tips for Exchanging Leftover Currency

All travelers often find themselves with leftover currency. To maximize your remaining funds, consider the following tips:

- Exchange at local banks for better rates.

- Use currency exchange kiosks only if necessary.

- Check if your hotel offers currency exchange services.

- Plan ahead by knowing exchange rates before departing.

Thou can also find valuable insights in Travel Tips: How to Exchange Money Before Traveling.

Converting Back to Home Currency

The best approach to convert leftover currency back to your home currency is to visit a reliable currency exchange service. These services typically offer a better conversion rate than kiosks at tourist hotspots. Ensure you bring adequate identification, as it may be required for larger exchanges. Always check for fees upfront to avoid any surprises.

Donating or Keeping Foreign Currency

Converting leftover currency isn’t the only option; consider donating it to charities or nonprofits that accept foreign money. Not only does this help those in need, but it also allows you to contribute positively while traveling. If you keep your leftover currency, it may serve as a unique souvenir or a handy resource for future travels.

Plus, keeping leftover currency can be practical, especially if you plan to return to the same country. It saves you the hassle of exchanging money again and allows you to jump straight into activities upon your return. Alternatively, many organizations gladly accept donations, converting your foreign currency into funds that support important causes. Always look for local charities that operate in your area to find a worthy recipient for your leftover cash.

Conclusion

Now that you understand the key strategies for managing currency exchange on your international trips, you can ensure a smoother travel experience. Start by researching current exchange rates, using reliable platforms and credit cards with favorable rates. Consider exchanging a small amount of cash before you go, and utilize ATMs efficiently while abroad. With these tips, you can confidently navigate foreign currencies and focus more on enjoying your journey.

Q: What are the best ways to exchange currency before my trip?

A: To ensure you get the best rates and avoid excessive fees, consider the following options:

1. Bank or Credit Union: Visit your local bank or credit union, as they often provide competitive exchange rates with lower fees compared to currency exchange kiosks.

2. Online Currency Exchange Services: Websites like Wise or Revolut allow you to exchange currency at more favorable rates. You can transfer the amount to a local bank, or order a currency card to use during your travels.

3. Currency Exchange at the Airport: This option is provided for convenience, but it tends to have higher fees and less favorable rates. If you must use this service, exchange only a small amount to cover immediate expenses like transportation and food.

Q: What should I consider when using my debit or credit card abroad?

A: Using your debit or credit card while traveling can be convenient but comes with considerations:

1. Foreign Transaction Fees: Many banks charge a fee for transactions made in a foreign currency. Check with your card issuer to know their policy and consider obtaining a card that waives these fees.

2. Dynamic Currency Conversion: Sometimes when making a purchase abroad, you may be offered the option to pay in your home currency. This is usually unfavorable, as the conversion rates can be significantly higher. Always choose to pay in the local currency.

3. Inform Your Bank: Notify your bank of your travel plans before your trip to prevent your card from being flagged for suspicious activity, which may lead to it being temporarily blocked.

Q: How can I safely carry cash while traveling internationally?

A: Carrying cash requires precautions to ensure your funds are safe:

1. Carry Various Denominations: It’s wise to carry a mix of small and large currency notes for flexibility. Small bills are useful for tips or small purchases, while larger ones may be needed for bigger expenses.

2. Use a Money Belt or Hidden Pouch: Instead of keeping all your cash in your wallet, consider a money belt or hidden pouch under your clothing for your larger sum of cash, while keeping a smaller portion easily accessible for daily spending.

3. Secure Locations: Use a secure, lockable hotel safe for keeping the bulk of your cash and travel documents. Avoid displaying large amounts of cash in public or during transactions to minimize the risk of theft.